Retrospective 2020 - The pandemic downturn of the art market

In 2020, the pandemic hit the economic world as a whole and the art market was no exception, especially since from the outset, the cultural world proved to be a non-essential sector for governments. Its dependence on the wellbeing of the economy as a whole even made most observers bet on a sharp decline in the art market for 2020.

2 years after the epidemic started, we offer you a retrospective on how the art market actually behaved and on the reactions of an entire sector to limit the impact of an unexpected crisis.

The onset of symptoms

The first half of 2020 saw the international market drop by 22% compared to the results of 2019. The slowdown observed in the first 6 months of 2020 was so brutal that forecasts announced an art market returning to the level of 2009 /2010, the last known major recession for the sector.

Like the pandemic, the decline in the art sector has been worldwide, severely impacting the three major places of art sales: the United States, England and China.

From a global point of view, the diagnosis of the results for the first half of 2020 indicated very worrying trends for the entire sector. While the West suffered from a fall of -60%, China saw its market fall by -91%.

Despite the cold sweats felt by all the players, it was necessary to get down to finding the remedy that would stem the evil and restore vitality to a paralysed market.

The root of all evil

As surprising as it is, the creative sector had to begin a methodical analysis to provide the most adequate response to a situation never seen before. Two findings were the basis of the response that would allow the patient to miraculously recover.

First, the health crisis provided a welcome and surprising realisation. Unlike 2009, the decline was not due to a financial crisis and a loss of liquidity on the buyer side. It is above all the general lockdown, isolation measures and closures that resulted in the market downturn in 2020.

To the mandatory closure of the places of sale, it was necessary to add the reaction of the buyers. As expected, they adopted the posture of caution inherent in any form of crisis. And so, even if the funds were available, collectors preferred to postpone their acquisitions until more reassuring times.

A first observation therefore emerged from the analysis of the problem: cash is available and purchasing intentions remain. This base was reassuring enough to make the changes that would reassure the market on the one hand and on the other hand provide the necessary impetus to catch up with the delay incurred during a catastrophic first half.

The second observation appeared following an inevitable introspection of the sector: the fact of having delayed their digital transformation was going to require many players to work twice as hard to operate the pivot towards digital technologies.

Thus, to initiate the reversal of the trend caused by the pandemic, a whole section of the art market would have to reinvent itself in order to offer a digital experience sufficiently convincing for buyers to overcome their concerns.

An encouraging recovery period

All in all, 2020 ended on a high note.

First, following an emergency digital transformation, collectors reinvested in the sector from the start of the second quarter.

Moreover, this return to activity has been dazzling. During the last 6 months of 2020, sales literally took off, seeing record acquisitions made in both the West and the East.

We must salute the dynamism of the art dealers who, through their pugnacity, have enabled this recovery. Indeed, the latter have spent considerable energy to support the business and defend a cultural sector overshadowed by the health emergency.

Thus, after a catastrophic first half, the year 2020 ends with an increase of 7% in the West and 71% in China.

These unexpected results will prove to be the start of a record-filled year 2021.

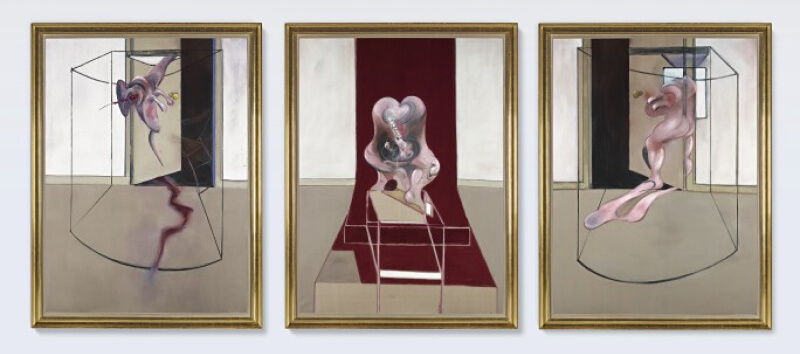

Triptych by Francis Bacon "Inspired by the Oresteia of Aeschylus" - Photographed at Sotheby's

The surprising effects of Covid on the art market

Si les acteurs du marché des beaux-arts peuvent se féliciter d’avoir sauvé leur secteur d’activité, force est de constater que les efforts consentis ont également profité d’effets positifs, pour le moins, inattendus.

Effect No. 1: Millennials to the rescue of the art sector

By choosing to turn to digital technologies, the art market has put itself on the radar of the so-called millennials who have shown a growing interest in the fine arts. So much so that the Internet sales rate doubled during the 2020-2021 period.

Although the digital transformation was primarily beneficial to the major auction houses, it should be noted that young audiences first acquired affordable pieces from galleries present on social networks.

This strengthening of online sales required a good dose of adaptability on the part of the players who had to understand the habits of their new audience. For example, the loyalty of buyers for a particular gallery has proven to be a particularly fluctuating parameter on the Internet. Buyers move quickly from one platform to another and go on to purchase without considering the brand that put the work up for sale.

Galleries new to the internet have also had to adapt their sales journey to mobile devices to meet their audience since internet shopping has mostly been done from phones and tablets.

The use of social networks is another consumption habit to which art sellers have had to comply. And more specifically, it appeared that Instagram has established itself as the most popular platform for millennials to discover the art world and learn about the market.

Finally, observations of the development of the online market have also led to the observation that purchases during the Covid period have been made in a committed manner. Indeed, the primary motivation of this young audience was the desire to help a sector in danger.

Effect No. 2: The rising stars upset the established order

Increased activity on Instagram has also brought a new generation of artists closer to this newly acquired audience.

This connection without intermediation contributed to ousting the specialised galleries which until then played a role of facilitator between buyer and artist.

This disruption in the established order has thus enabled artists to become influencers capable of promoting themselves and the artistic approach that drives them.

However,we have to accept that digital technologies have a limit: the lack of emotional feelings sparked by the physical experience of the object.

Indeed, 47% of newly acquired collectors testify to their need to contemplate the physical work before making a purchase.

However, online art sales have experienced unprecedented enthusiasm, posting a growth of 72% for a sales amount reaching 6.8 billion dollars.

In conclusion, it is up to established players to work on the digital experience they offer to overcome the limits of technology.

For example, to convert more millennials, they can select works that meet the preferences of this new audience or offer a user experience that compensates for the absence of “physical” contact.

Effect No. 3: Mixed results and lasting trend

Although they reacted quickly, the situation for each business is different after this health crisis.

If the major auction houses have been able to deploy the necessary means to adapt their model and ensure the continuity of their activities; many “small” players, deprived of their public, their fairs, the purchases made by museums and income from renting out their spaces, have unfortunately had to go out of business.

For those who have successfully navigated through the difficulties, the digitalisation of their sales model has proven to be a winning bet.

By developing “viewing rooms”, auction houses and galleries have been able to leverage the millennials to catch up on the “pure players” already well established on the Internet.

On this point, the auction house owned by Patrick Drahi led the race, alone achieving 65% of the 671 million dollars in total online sales.

The vision for the future of actors who have opted for the digitisation of their business is encouraging. 80% of them believe that the unexpected results obtained following their digital shift reflect a lasting trend and suggest possible progress in the years to come.

For this promising observation to materialise, it will be essential for art dealers with more modest means to correctly assess the challenges linked to digitisation, such as finding their place in a context of globalised competition.

In addition, it will be an absolute necessity for them to adopt transport and installation protocols adapted to the fragility of the products they market. The establishment of partnerships with service providers specialising in the logistics, packaging or storage of works of art must therefore be studied carefully to ensure the satisfaction of the most demanding collectors.